Definition and Examples of Spot Rates A spot charge is the cost at which an asset can be quickly exchanged. Like all charges, the spot charge is determined by supply and demand for that individual asset.

Economic solutions organizations sell blocks of ETF shares (called “generation models”) to broker-sellers to ensure the share price ranges of ETFs continue being primarily according to the fundamental index or the prices on the assets held through the fund.

The NAV is really an accounting system that decides the overall worth of the assets or shares within an ETF.

"Our benchmark grain and oilseed futures solutions are by far the most liquid and highly-used markets in worldwide agriculture nowadays," John Ricci, controlling director and world wide head of agriculture, stated in a very January push release.

In commodities markets, spot rates identify The existing selling price for quick supply of raw products like oil, gold, and agricultural goods. These rates are formed by elements for example geopolitical tensions, climate activities, and supply chain disruptions.

Most up-to-date Tales Organization Insider 4d Gold is so high-priced that some jewellers are turning to a different precious steel — and it isn't really silver Price ranges of platinum, a white precious metal, have rallied about thirty% this yr, echoing try this web-site strong gains in gold price ranges.

Right now, many individuals around the globe use ETFs to entry the economic markets in the same way as the most important institutional buyers — with the clicking of a button, for just a known price.

In the oil market, backwardation could occur if there’s a brief-phrase supply disruption, triggering the current selling price to spike though upcoming costs keep on being decrease, reflecting expectations of supply returning to standard.

If a mutual fund manager buys and sells assets regularly, you can be about the hook for short-time period cash gains taxes. Mutual fund taxes are factored at the end of the year, so there’s the likely that you could potentially end up getting a significant tax Monthly bill, depending on how the fund was managed.

There are actually ETFs depending on Just about almost any protection or asset out there in monetary markets. Inventory ETFs observe shares of corporations in one business or a person sector.

Motion during the spot market is dominated by Specialized and Elementary trading. Complex investing consists of charting and graphs, whereby most investing conclusions are established from technical signals which have been derived in the charts.

In bond markets, the distinction between spot rates and coupon rates is critical. While the my latest blog post coupon rate signifies a bond’s mounted interest payment, the spot level visit our website discounts these payments to existing price.

A spot rate is set dependant on just what the get-togethers associated are practical with. It can be the worth established based on the value that a purchaser is willing to spend and the price that the vendor is ready to acknowledge from customers. It may well change with time and place.

Find out why diversification is so crucial to investing And just how it can help investors lessen risk, enhance returns, and navigate speedy-switching markets.

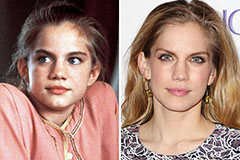

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now!